It appears we may just finally have some more Wyatt Earp in place of Billy the Kid in the insurance appraisal industry. Gentlemen and Ladies, check your guns at the city limits of Dodge!

The state of the appraisal process has been all over the board depending on the insurance company and locale for the last several years where the property claims appraisal process has expanded in use. Now with all the different states and their interpretations and understanding of the appraisal process in the property damage claims business, it is like an eel on a deep-sea fishing trip … the harder you squeeze the more likely it is to get away. The most important and paramount in this process for me is that we understand that we as appraisers and umpires are not in this capacity as judges, lawyers, advocates, agents or policyholders.

In its truest form we are simply the recorder of the facts.

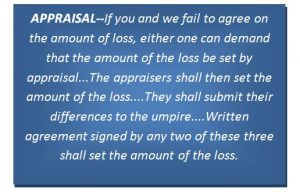

Appraisal — The process varies from state to state depending on the experience of the state with appraisal to date. These details per state are a discussion in case law, beyond what I am qualified to opine on. I can write a clean appraisal but I cannot tell you how to do so. In many states, either party can demand an appraisal, while in some states, the choice must be bi-lateral. The question as to whether or not an appraiser can call causation remains the gumbo of the day. The award is essentially the amount of loss broken out by coverage and signed by two. In my opinion, any estimate or appraisal, unless specifically referenced within the 4 corners of the award, is just for informational purposes and more or less identifies the damage. FYI – The right number sometimes comes before the “perfect” estimate.

In Florida, we have recently seen the appearance of SB 336- Property Insurance Appraisals. The bill would go a long way towards providing some ground rules and accountability in an industry that in some cases could use some. Most of the rules are already practiced and part of the commitment made by appraisers adhering to the rules of ethics established by mentors like John Voepel, CPCU with the Wind Network, including an Umpire Code of Ethics.

Other organizations like the Insurance Appraisal & Umpire Association also train umpires and appraisers on the correct methods for performing our role. Not many states that I have found require licensing and one of the first I found to be established was, of all places, Louisiana! After Katrina, the Dept. of Insurance there sure had enough experience with disputed claims. Their department created the following detail for appraisers after they passed the requisite background and experience threshold checks. Here is my license: Louisiana Dept of Insurance – Licensed Appraisers.

While it appears Florida is moving forward with at least identifying appraisers as Louisiana does, in my opinion, the real leader as to establishing the conduct of appraisers and umpires is Colorado, where appraisers are required to follow the same rules as other professionals in the alternative dispute resolution process. Please see DORA – Bulletin B-5.26 – Disputed Claims subject to Appraisal for a discussion of the rules of the road in Colorado.