Assignment of Benefits

Read this full article to get the full breakdown of what exactly an Assignment of Benefits (AOB) is and what your next steps will be if you choose to move forward with one.

Condo and Co-Op Registration Information With The DBPR

The DBPR is live with the registration docs for their January 1, 2023 deadline now. Please register your condo before December 31, 2022.

Team Complete is here to make this process smoother. Click the link below for registration docs and submission instructions:

http://www.myfloridalicense.com/DBPR/condos-timeshares-mobile-homes/building-report/

Miami-Dade County Condo Recertification Documents

Our expert Forensic Engineers and licensed General Contractors break down the science to assure that your condo building meets the certification requirements.

At Team Complete we have a culture of collaboration and want to make the recertification process as painless as possible.

* All documents originally sourced from the Miami-Dade County website*

General Guidelines and Templates Forms

General Considerations & Guidelines

Forms to be used on recertifications for 2022 and onward

General Consideration & Guidelines

Minimum Inspection Procedural Guidelines Structural Recertification

Minimum Inspection Procedural Guidelines electrical recertification

Certification of Compliance with Parking Lot Illumination Standards

Certification of Compliance with Parking Lot Guardrails Requirements

Forms to be used on recertifications for 2021 and before

Minimum Inspection Procedural Guidelines Structural Recertification

Minimum Inspection Procedural Guidelines Electrical Recertification

Certification of Compliance with Parking Lot Illuminations Standards

Certification of Compliance with Parking Lot Guardrails Requirements

Call Team Complete today to get started on your recertification

Link to Submission Portal (CLICK HERE)

Link to Miami-Dade County Condo Recertification Site (CLICK HERE)

TEAM COMPLETE IN THE NEWS – 850 magazine feature article

*Content originally published on June 13, 2022 by 850 magazine*

Completely Covered

Mother Nature is unpredictable; Team Complete is always dependable

Photo originally captured by CGC Fixing people’s problems has long figured in John Minor’s life.

Minor grew up carrying his father’s toolbox in and out of every house in Gulf Breeze, Florida.When Hurricane Opal came calling for everything that his family had built on Soundside Drive, he knew the challenge that would become his life’s work.

Today, Minor is helping others as the President of Complete, Inc., a professional services firm that specializes in insurance claims appraisal, an alternative dispute resolution process and property damage forensics. His group is made up of certified general contractors, floodplain managers, licensed insurance appraisers, engineers, thermographers and remote pilots serving insurance companies, municipalities, counsel and select property owners on complex losses originating from hurricanes, fires and other construction challenges.

When Minor first started his career restoring his neighbors’ properties, he was trained by Paul Davis Systems where Bill McBride gave him a chance. That was a long time ago when the industry was different with many more handshakes and kept promises. Since then, the storm names have changed, but people know who they can trust. They can and do trust Minor and his team, with some of the largest, most delicate and important property claim disputes.

Matt Miller, John Minor and Mike Sico. Photo by LoveMate Photography Minor has spent a career studying hurricanes, sometimes from the inside out..Minor works along-side University of Florida’s FCMP, which collects valuable data by putting equipment in the paths of landfalling hurricanes. Minor is the first truck in and the last one out. Minor, a trial-tested expert, has been requested to lecture on restoration, appraisal and construction pricing at the National Hurricane Conference, Lorman Education Services, FSU stormrisk.org, among other educators.

Check out the full feature article HERE.

Team Complete

(850) 932-8720 | (844) 932-8720 | TeamComplete.comLearn more about our Complete team

Keep up with COMPLETE IN THE NEWS

FL Legislative Update: Condo-Safety Act

FLORIDA HOUSE OF REPRESENTATIVES

FL Legislative Update: Condo-Safety Bill

May 25, 2022

FL Legislature takes up condo safety bill during its special session

Update: The House Appropriations Committee approved HB 5-D, Condo Safety Bill, late Monday evening. The Senate approved SB 4 Tuesday evening, related in part to condominium and cooperative association buildings that are three or more stories. * UPDATE- Gov. Ron DeSantis signed the bill into law on May 2022*

A House-Senate compromise bill (HB 5-D) would subject older condominium and cooperative buildings to routine inspections and end the ability of association boards to waive owner assessments needed to pay for repairs.

“The associations will no longer be able to waive the requirement of reserves which currently exist. That is the most important part of the bill for those of us in the House,” the House sponsor, Republican Danny Perez of Miami-Dade County, told reporters following that chamber’s vote.

Condo Safety Bill Key Provisions:

- All Buildings built prior to 1982 have already received their 40 year inspection, and will continue to follow the established schedule after their initial inspection.

- Required milestone inspections for any structure of three stories or more in height 30 years after it receives its certificate of occupancy and every 10 years thereafter. (If the structure is within three miles of the coast, the first inspection would come 25 years following the certificate’s issuance.)

- Boards would have one year to begin any recommended repairs.

- Associations will no longer be able to waive assessments needed to pay for repairs to roofs, load-bearing walls and structural members, foundations, fireproofing and fire-protection systems, plumbing, electrical systems, waterproofing and exterior painting, and windows.

- Audited Reserves to make sure associations can afford to maintain structural integrity.

MIAMI-DADE COUNTY

Changes effective January 2022

The recertification program in Miami-Dade County has been strengthened to include inspecting additional building components and providing a more detailed look into existing buildings. Approved by the Board of Rules and Appeals (BORA), the updated guidelines and report templates have been revised and are available below. Information about how the new guidelines and report templates have changed is also available below.How the process starts

Each year, new properties become subject to the recertification process at 30 years and every 10-year interval thereafter for the life of the structure, pursuant to Section 8-11(f) of the Code of Miami-Dade County. For those properties that require certification, the property owners receive a Notice of Required Recertification to commence the process. The recertification reports must be submitted within 90 days from the date of notice.Note that the following types of residences do not go through the recertification process: single-family homes, duplexes, and buildings with 10 occupant load or less and 2,000 square feet or less.

After Notification

Property owners must submit written recertification reports prepared by a Florida-registered professional engineer or architect, certifying each building or structure is structurally and electrically safe for the specified use for continued occupancy. The design professional must have proven qualifications by training and experience in the specific technical field covered in the inspection report (structural and/or electrical) as per the Miami-Dade County Code.READ THE FULL PROVISION HERE

READ MIAMI DADE MEMORANDUM HERE

SEE CONDO RECERT DOCUMENTS HERE

South FL Condo Buildings Require 40-year Recertification Inspection

Florida Condo Building – Photo by Complete The need for professional inspections of multifamily mid-and high-rise structures has never been clearer than in recent times. Our firm has been a leader in water intrusion and building inspection services for more than 20 years and we welcome this attention to detail.

Our engineers expect that there will be major changes in the state of Florida requiring inspections and maintenance of our aging building stock. These requirements for inspection and repair are a tool and guideline for the overarching need to maintain these often-times waterfront condos.

While they are only a requirement at 40 years of age and every 10 years thereafter in Broward and Dade as of the fall of 2021, boards of directors and property managers can expect to see these requirements to come from a county hall near you soon!

We hope that this attention to safety will gain traction and encourage unit owners to understand the enormity of the challenges faced by older buildings on the coast and to value good maintenance practices when they pay their dues, when they vote for condo officers, and when they purchase only well-maintained structures.

When it is all broken down this is a financial issue, dollars and cents, and those meetings require difficult decisions to be made to protect communities and the people that make them up. A common sense approach to maintenance begs for long term planning, supported by reserve studies, based on the realities of fluctuating construction costs and real life age expectations for as-built roof and wall claddings and other building systems. These costs of quality maintenance can and should be manageable, and that is the blueprint we hope to provide in our building certification and condition reports.

Condominium buildings, in a small footprint, provide sanctuary to many lives and families. The design of condo living includes all the members of the Home or Condo Unit Owners association having a fractional ownership in the building as a whole. The nature of a Homeowners Association (HOA) also prescribes how a building is to be insured, the voting rights of the members and creation of a Board of Directors. The unit owners elect the board, and the board is given many responsibilities. The responsibility of the HOA includes the requirement to provide insurance to protect against losses, to maintain the building, and to collect dues amongst others. Board membership is sometimes a difficult job, but one of critical importance in protecting a community. Local government can assist HOA and unit owners by adopting language in regards to safety inspections of structural, electrical and lighting components of a building. Following is an example of how this was done in South Florida following the collapse of the Miami Field Office of the DEA, tragically killing seven on August 5th, 1974.

Beach Front Condo Building – Image by Complete From Florida Board of Professional Engineering (FBE)

Subsection 104.6, SFBC, Structural Determination, defined structural as “any part, material or assembly of a building or structure which affects the safety of such building or structure and/or which supports any dead or designed live load and the removal of which part, material or assembly could cause, or to be expected to cause, all or any portion to collapse or to fail.”

The building officials were required to send a “Notice of Required Inspection” to owners of buildings 40 years or older regarding recertification. The owner had to provide a written report, prepared by a Professional Engineer or architect registered in Florida, certifying that a building was structurally safe for the specified use or continued occupancy in accordance with the Recommended Minimum Procedural Guidelines for Building Recertification issued by the Building Official.This applied to all buildings except single-family residences, duplexes, and minor structures. Minor structures have an occupant load of 1O or fewer and a gross area of 2,000 square feet or less. “The report shall only be made by an engineer or architect qualified by training and experience. The report must indicate the manner and type of inspection forming the basis for the report,” as stated in the building code.

Report Categories

When drafting the report, consider these categories:• Foundations

• Roofs, roofing

• Bearing walls

• Floor systems

• Concrete framing systems

• Steel framing systems

• Windows, wall openingsYou can read this entire article by the FBPE here.

Florida Condo Construction – Photo by Complete The mixture of ownership within a condo is complex and overlapping but the responsibility for structural stability remains with the HOA. This should work fine with the the replacement of roofs at 20-to 40-year intervals but can become more complex in the vertical walls. Fenestration systems or windows can be a large driver of water intrusion in condo structures and are reliant on an HOA-installed and maintained stucco or other siding system. Some homeowner boards allow individual owners to contract their own window replacements with the obvious challenges.

We wrote another post about the the duty to insure further clarified in Florida by statute and in other states by the by-laws.

Florida’s method of HOA responsibility as a state statute is best, as it provides continuity across the industry. In essence, the HOA is to provide for maintenance and an insurance policy designed to protect the exterior of the building. This protection covers the exterior, whether that is stucco, brick or siding, the windows and doors, plus the structural walls behind them. Some buildings are concrete and rebar, some wood, and some steel-framed with infill of metal studs. The HOA is responsible for any central HVAC electrical and plumbing systems and the wall board, drywall or plaster walls. Unit owners must acquire an HO6 policy in Florida which provides coverage for the finishes – ceiling, wall and floor, the trim, and the cabinets.

In the same way that the condo HOA policy requires insurance on the buildings structures so exists the duty to maintain these portions of the building. Maintenance is expensive and damages to a structure can often go undetected by the untrained eye. Water is the enemy of materials and is the basis for most issues in construction. The introduction of water and the salts and other corrosive materials behind condo walls is the beginning of a slow death for a building, and only careful attention to inspection and maintenance will keep rust or rot at bay.

Complete is a licensed general contracting and engineering firm specializing in the study of the built environment with our suite of construction and engineering professionals. Our team has inspected thousands of properties across the southeast for more than 25 years. We have a genuine desire to help our clients make good, sound decisions that they can feel confident about based on actionable, well-reasoned reports from seasoned engineers. Our team is a high tech one that relies on moisture mapping and thermal imaging, both hand held and drone-mounted, to identify latent water issues in concrete construction by FLIR certified staff. We use 4D mapping software and our in-house team of FAA 107 licensed remote pilots to gather extremely high resolution images for study and reporting purposes. The inside staff at Complete writes reports that work that convey the message and give you the ability to make the right decisions. We have been involved in the restoration of commercial and residential structures for all of the 25 years the firm has been in business and we hope to show you why we continually get hired by the best in the business.

UPDATE

2022 Condo Safety Bill establishes state mandated Milestone Inspections and Structural integrity Reserve Studies, along with many new updates in response to the Surfside Building Collapse. (CLICK HERE to learn more)

-

FBPE on 40 year cert

FL BPE

-

FBPE on 40 year cert

Engineer-Led, Remote-Piloted Catastrophe Response

Smart remote sensing technologies used by our Meteorologists, Engineers, General Contractors and Floodplain Managers are a hallmark of our Team and set our clients ahead.

Hurricane Research and Property Damage Assessment

Our research endeavors have had us at the site of nearly every land-falling hurricane to hit the Southeast over the last decade. We have been studying and reporting on the effects of weather our entire careers and continue to be at the leading edge of hurricane research. This area of scientific study not only helps us in understanding our built environment and the real effects of wind and surge following a hurricane, but also allows us to provide real facts to our clients.

CGC Team Cat Field Operations Support SXS Our forward people will typically be as close to the landfall as we can practically manage. In Hurricane Michael, we used the Mexico Beach boat ramp within days of the storm. Our drones then took to the air and our teams fanned out on our side-by-sides and 4×4’s. We collected high water marks contemporaneous to the USGS and cataloged wind damage above the flood line.

We brought floodplain managers, meteorologists, structural engineers and general contractors and supported them with in-field temporary housing, generators and a fleet of drones. Our team from Mexico Beach then ran the data in a hard drive out to our Pensacola office for fast internet up-link and review.

CGC Mexico Beach – Hurricane Michael CGC Mexico Beach Post Michael CGC Mexico Beach – Hurricane Michael CGC – Tyndall – Hurricane Michael CGC Aerial Imagery – Hurricane Michael CGC – Mexico Beach – West End CGC – Aerial Imagery Support Team CGC – FAA 107 Drone Operations – Cat Team CGC – Mexico Beach Hurricane Michael Team Complete – Mexico Beach – Hurricane Michael Team Complete – Mexico Beach – Hurricane Michael Team Complete – Mexico Beach – Hurricane Michael Team Complete – Mexico Beach – Hurricane Michael Team Complete – Mexico Beach – Hurricane Michael Team Complete – Mexico Beach – Hurricane Michael Team Complete Images from our inspections immediately following Hurricane Michael Online Forms

Complete, Inc. is happy to provide the following online forms to our friends and customers. If you find yourself in need of appraisal, construction, expert witness or restoration services, give us a call today and let Complete handle your needs with the prompt, professional service upon which we have built our reputation.

Wind V. Flood

-

Wind V Flood - presentation for Florida State University - School Of Business - John Minor (PDF)

Wind V Flood - John Minor - Stormrisk.org

- Wind V Flood - presentation for Storm risk .org (PPT)

- FEMA - Wind V Flood Investigative Tips W-08008 (PDF)

- FSU PowerPoint (PPT)

- Hurricane Claims - Costs codes & prevention (PDF)

- Ondis v State Farm (PDF)

- Vista Power Point (PPT)

- Wind v Flood 2009 v 09 09 (PPT)

- Wind v Surge - John MInor CGC, CFM @ Windstorm Conference 2009 (PPT)

- Wind v Surge v.06-2010 (PPT)

-

Windstorm Conference - Houston - Wind v Flood 2009 (PPT)

Wind V Flood - John Minor CGC, CFM

-

Wind V Flood - presentation for Florida State University - School Of Business - John Minor (PDF)

Labs and Testing

-

Environmental Microbiology Laboratory, Inc.

Environmental Microbiology Laboratory, Inc. specializes in the analysis of air and surface samples for fungi, mold, bacteria, allergens, and asbestos. EmLab is the leading commercial indoor air quality testing laboratory in North America.

- Phoenix EnviroCorp

-

Environmental Microbiology Laboratory, Inc.

Insurance Claims Resources

Informational Resources

-

Mold Report

Online store and other information about Mold Report

-

Smithsonian Museum Conservation Institute

Guidelines for caring for and preserving furniture and wooden objects, paper based materials, and preservation studies.

-

An Office Building Occupant’s Guide to IAQ

U.S. Environmental Protection Agency (EPA), Indoor Environments Division (IED)

- Biological Pollutants’ Impact on Indoor Air Quality

- Building Air Quality Guide: A Guide for Building Owners and Facility Managers

- Creating Healthy Indoor Air Quality in Schools

- Flooding

- Indoor Air Quality (IAQ)

- Indoor Air Quality in Offices and Other Large Buildings

- Mold Resources for Schools and Commercial Buildings

-

Mold Report

Hurricane Information

- National Hurricane Conference 2011 (DOC)

-

Florida Coastal Monitoring Program - Hurricane Harvey Observations (PDF)

Florida Coastal Monitoring Program - Hurricane Harvey Observations

- Hurricane Irma 2017 – National Weather Service

-

Irma Survey 10.26.17 (PDF)

Hurricane Irma 2017 - NWS document

- NWS Miami Hurricane Irma Post Analysis (PDF)

- Hurricane Michael 2018 – National Weather Service (PDF)

- Hurricane Michael Data – Florida Office of Insurance Regulation (PDF)

Flood Insurance

FEMA

L273 Visual

- Flood of 1927 (AVI)

- Instruction Memo (PDF)

- Private Flood Insurance (PDF)

- Proof of Loss (PDF)

- Testimony of Administrator Craig Fugate (DOCX)

- Handbook for Disaster Assistance (PDF)

- Help After a Disaster (PDF)

- FEMA - Flood & Wind Mitigation Accomplishments 2010 (PDF)

- FEMA Homeowners Guide to Retrofitting P-312 2nd Ed 2009 (PDF)

- FEMA Recommended Residential Construction for Coastal Areas P-550 2nd Ed 2009 (PDF)

- FEMA Users Guide to Technical Bulletins TB0 (PDF)

- FEMA Hazard Mitigation Brochure (PDF)

- Flood and Wind Mitigation Accomplishments in 2010 and the First Quarter of 2011 (PDF)

- FEMA Reinforce or Replace Garage Doors HOW 2016 (PDF)

- FEMA Protect Windows and Doors with Covers HOW 2017 (PDF)

- FEMA Brace Gable End Roof Framing HOW 2018 (PDF)

- FEMA Secure Composition Shingle Roofs HOW 2031 (PDF)

- Secure Built-Up and Single-Ply Roofs (PDF)

- Rebuild Northwest Florida (PDF)

Equipment and Supplies

- 3M Company

- Alpine Air

- American Shrinkwrap Co.

- Anderson Windows, Inc. Division Anderson Corporation

- Armstrong World Industries, Inc.

- Austin Mohawk, Inc.

- Benjamin Moore & Co.

- Berridge Manufacturing Company

- CB&I Inc. (formerly Howe-Baker), Sonozaire® Odor Neutralizers

- CertainTeed Corporation

- Clean Aire, Inc.

- Cleaning and Restoration Supply (CRS)

- Dayton Superior Corp. – Symons Forming Systems

- Dulux Paints

- Inline Distributing Company

- Jon-Don, Inc.

- Juno Lighting Group

- Kohler Company

- Lincoln Windows

- Ludowici Roof Tile

- Moen Inc.

- Munters – Moisture Control Services

- Porcelanite, Inc.

- ProRestore Products – UnSmoke and Microban

- Pro Spec

- Sherwin Williams Company

- Sun-Belt USA

- Trinity – Vac Systems

Construction Documents

Construction and Engineering Firms

Chambers of Commerce

Building Science

- Tile Terminology (DOCX)

- K17933-FlashingGuidelinesBEFORE-10-30-11 (PDF)

- PermaBarrierWallFlashing (PDF)

- Royal Sovereign & Sentinel 25 yr 110 moh shingle (PDF)

- selfSealingAsphalt-TechBulliten1-sealStrip (1) (PDF)

- selfSealingAsphalt-TechBulliten2-windResistance (PDF)

- selfSealingAsphalt-TechBulliten3-windDamage (PDF)

- TAS 105-98 (PDF)

Building Codes

1969 SBC Building Codes

1973 Building Codes

Additional Building Code Documents

Associations and Institutes

- American Architectural Manufacturers Association

- American Concrete Institute

-

American Conference of Governmental Industrial Hygienists, Inc. (ACGIH)

Occupational and environmental health and safety information.

-

American Industrial Hygiene Association

Information on industrial hygiene and indoor air quality issues including mold hazards and legal issues.

-

American Society of Heating, Refrigerating, and Air-Conditioning Engineers, Inc. (ASHRAE)

Information on engineering issues and indoor air quality

- American Society of Testing and Materials

-

Association of Occupational and Environmental Clinics (AOEC)

Referrals to clinics with physicians who have experience with environmental exposures, including exposure to mold; maintains a database of occupational and environmental cases.

- California Environmental Protection Agency

-

Centers for Disease Control and Prevention (CDC)

Information on health related topics including asthma, molds in the environment, and occupational health.

- Claims Yellow Pages

-

Carpet and Rug Institute (CRI)

Carpet maintenance, restoration guidelines for water-damaged carpet, and other carpet-related issues.

-

Energy and Environmental Building Association

Information on energy efficient and environmentally responsible buildings, humidity and moisture control, and vapor.

- Environmental Protection Agency

-

Institute of Inspection, Cleaning and Restoration Certification (IICRC)

Information on and standards for the inspection, cleaning, and restoration industry.

-

International Sanitary Supply Association (ISSA)

Education and training on cleaning and maintenance

-

International Society of Cleaning Technicians (ISCT)

Information on cleaning, such as a stain removal guide for carpets.

- Mississippi Emergency Management Agency

-

National Air Duct Cleaners Association (NADCA)

Duct cleaning information.

- National Association of Homebuilders

-

National Association on the Remodeling Industry (NARI)

Consumer information on remodeling, including help finding a professional remodeling contractor.

-

National Institute for Occupational Safety and Health (NIOSH)

Health and safety information with a workplace orientation.

-

National Institute of Building Sciences (NIBS)

Information on building regulations, science, and technology.

-

National Institute of Environmental Health Sciences

The mission of NIEHS is to reduce the burden of human illness and disability by understanding how the environment influences the development and progression of human disease. Reference for information on mold.

-

National Institutes of Health

The Nation’s Medical Research Agency – information regarding environmental health issues, including IAQ.

-

National Pesticide Information Center

Information on pesticides and antimicrobial chemicals, including safety and disposal information.

-

Occupational Safety & Health Administration (OSHA)

Information on worker safety, including topics such as respirator use and safety in the workplace.

-

Restoration Industry Association (RIA, formerly ASCR)

Disaster recovery, water and fire damage, emergency tips, referral to professionals.

-

Sheet Metal & Air Conditioning Contractors’ National Association (SMACNA)

Technical information on topics such as air conditioning and air ducts.

Appraisers and Umpires

- 2012 WIND Umpire Directory (PDF)

- 10 Xactware Overhead and Profit June 2011 (PDF)

- 18 BONUS Social Media Explained (PDF)

- 17 Order Form - Law and Procedure of Appraisal (PDF)

- 16 Need for Comml Lead Paint RRP Rule 01-08-13 (PDF)

- 15 Recent EPA Lead Paint Enforcement 02-18-14 (PDF)

- DFS-I0-2082 (PDF)

- F687 Claims Handbook (PDF)

- 14 Contractor Fined 30K for Lead Paint 10-23-13 (PDF)

- 13 Residential Solar Panel Coverage 11-27-13 (PDF)

- 12 Is Coinsurance Penalty ACV or RCV 11-04-13 (PDF)

- 11 Accurate Outcomes in Appraisal Spring 2012 (PDF)

- 09 Xactware Depreciation Information July 2011 (PDF)

- 08 TWIA Depreciation Factors (PDF)

- 07 NAHB Life Expectancy Depreciation Feb 2007 (PDF)

- 06 Florida SB 708 excerpt as of 02-13-14 (PDF)

- 05 Umpire Rate Agreement (PDF)

- 04 Appraisal Case Law Updates (PDF)

- 03 Appraisal Clause Examples (PDF)

- 02 Appraisal Forum Attendee Roster (PDF)

- 01 Appraisal Forum Agenda (PDF)

Appraisal Forms

Appraisal Case Law Resources

- 10Aa_AI_J_Product_Changes_Personal_Lines_Appraisal_Language (PDF)

- B Johnson v SF Lloyds (PDF)

- B-5.26-Requirements-Related-to-Disputed-Claims-Subject-to-Appraisal (PDF)

- Colorado-Appraisal-Dora-5-5.26 (PDF)

- D Carbonneau v Am Family Mutual (PDF)

- IN-RE-UNIVERSAL-UNDERWRITERS-OF-TEXAS-INSURANCE-COMPANY-1 (PDF)

- Legal_Defense_Billing_Forensic_Audit_Report_ (PDF)

- QBES Ins v French Ridge HO (PDF)

- SF-Appraisal-Doc (PDF)

- St. Charles Parish Hospital Service District No 1 V United Fire and Casualty Company (PDF)

- Triple-S-Properties-Inc_-v_-St_-Paul-Surplus-Lines (PDF)

- New_Home_Warranty_Act (PDF)

- shaw-opinion020 (PDF)

- FAQ_Consent_Order (PDF)

Hurricane Florence – Storm Damage – Coastal Carolinas – Outer Banks to Myrtle Beach

Hatteras Restoration by Complete The Carolinas have always treated Team Complete like a favorite son. As a construction company under the banner Complete, Inc. Unlimited General Contractors (License # 42065) we’ve been there from 1996 thru 2004 restoring properties damaged by builder liability water intrusion problems and from Hurricanes Bertha & Fran, Bonnie, Floyd and Isabel. Our hard when the hard construction side of Complete deployed to Hurricane Charlie.

Our love affair with the Wilmington area began in 1983 when founder John Minor attended JT Hoggard High and spent time at the beaches off Middle Sound Loop road. When Team Complete finally returned to Wilmington in 1996 the city had grown tremendously.

Hurricane Florence

September 14, 2018 – Hurricane Florence makes landfall around Wilmington, NC. Wind-driven water is being pushed inland while very heavy rain is rapidly increasing flooding. While Hurricane Florence had been downgraded to a Category 1 hurricane, it remains a heavy rain and storm surge threat. Hundreds of thousands of homes have lost power, and this slow-moving storm will remain in the Wilmington area for a number of hours.

September 13, 2018 – Hurricane Florence is a large, slow-moving storm moving towards the coastal regions of South Carolina and North Carolina. Evacuation orders are in place and the National Hurricane Center is predicting life-threatening storm surge is now highly likely along portions of the coastlines of the Carolinas. Complete Inc. asks all residents and business owners to take precautions now and to move to a safer location if you are in an evacuation zone.

This portion of the low country of S. Carolina around Myrtle Beach and then up to the outer banks of Morehead and Hatteras Island have construction that is forced to deal with potentially huge storms every hurricane season. Coastal Carolina gets everything from Nor’easters to Hurricanes to snow storms. The need for quality construction and exterior cladding that survive these type storms is paramount in the Outer Banks. The use of the best quality roofing materials, thicker heavier shingles and better installation techniques proves the benefit of better construction and the inadequacy of inferior work even sooner due to weather.

Wilmington including Landfall, Sea Trail & Porters Neck communities were the hot bed of synthetic stucco challenges in the 90’s and we were involved as the restoration contractor on millions of square footage of recladding projects. The work of restoring these properties led to the understanding of the root causes of these damages and the appropriate scope for repairs. It also allowed us to buy a lot of copper which lasts longer than many other materials.

We have restored hundreds of homes, condominium units, commercial and municipal buildings throughout the beach towns of North & South Carolina. We enjoyed doing special roofing projects at UNCW as well as App State in Boone where we built the Centennial Plaza. We were the restoration contractor for the Town of Plymouth and the representative for Dare county in dealing with The National Flood Insurance program post Hurricane Isabel.

We also restored the cedar shake, slate and terne metal roofs that make up the historic sections of North Carolina. Much of our experience was on the finest quality beach houses from Hatteras, Bald Head Island to Wrightsville Beach. This is Complete country and we are pleased to return to serve the needs of our clients and friends in North Carolina and South Carolina from The Outer Banks to Myrtle Beach.

Carolina Hurricanes:

- Hurricane Isabel – September 2003 – https://en.wikipedia.org/wiki/Hurricane_Isabel

- Hurricane Dennis – September 1999 – https://en.wikipedia.org/wiki/Hurricane_Dennis_(1999)

- Hurricane Floyd – September 1999 – https://en.wikipedia.org/wiki/Hurricane_Floyd

- Hurricane Bonnie – August 1998 – https://en.wikipedia.org/wiki/Hurricane_Bonnie_(1998)

- Hurricane Fran – September 1996 – https://en.wikipedia.org/wiki/Hurricane_Fran

- Hurricane Bertha – July 1996 – https://en.wikipedia.org/wiki/Hurricane_Bertha_(1996)

- Hurricane Emily – August 1993 – https://en.wikipedia.org/wiki/Hurricane_Emily_(1993)

North and South Carolina Hurricane Details:

Hurricane Isabel – September 2003

Hurricane Isabel was the most intense and costly hurricane that took place during the Atlantic hurricane season in 2003. Isabel first formed near Cape Verde, while going on to make impact in the Lesser Antilles, Puerto Rico, Greater Antilles, Turks and Caicos, Bahamas, North Carolina, Virginia and other American states.

When Isabel first made landfall in North Carolina in September 2003, it did so with sustained winds of up to 105 miles per hour. While it did weaken in the coming hours and days, it hit Virginia and western Pennsylvania with similar devastation.

The Outer Banks in North Carolina were completely devastated, while Virginia suffered a great deal of damage as well. Around 64 percent of the property damage and 69 percent of the deaths from the hurricane occurred in those two states.

Other American states that were hit by the storm include Maryland, Washington DC, New Jersey, New York and parts of New England. It even made its way up to Canada.

22 people died in Virginia and 12 in other American states directly or indirectly due to Isabel. And it caused a total of $5.5 billion in damages to the United States. The Caribbean islands were also damaged, while the Bahamas, Greater Antilles and other regions suffered property damage as well.

Hurricane Dennis – September 1999

Hurricane Dennis was a Category 2 hurricane that struck the Bahamas, North Carolina, Virginia, Maryland and Pennsylvania during August and September of 1999.

While Dennis had started as a tropical wave near Puerto Rico in late August, it eventually built up into a tropical storm. It first struck the Abaco Islands, met favorable wind conditions and strengthened into Category 2 status.

When Dennis made contact in Cape Lookout, North Carolina, it was a strong tropical storm that caused serious issues in the region. It continued up the U.S. east coast, striking several states along the way with serious winds and heavy rainfall.

The heavy rainfall, winds and powerful waves that occurred in the coastal regions of Florida, North Carolina and other American states caused devastation to nearby towns, while claiming lives as well. Around $157 million of damage was caused to Florida, North Carolina and Virginia.

The Bahamas also suffered significantly due to this hurricane, with intense winds of up to 75 miles per hour hitting parts of the region. The high wind and heavy rainfall resulted in a lot of flooding and property damage in the area. No lives were claimed in the region or anywhere else besides the state of Florida.

Hurricane Floyd – September 1999

Hurricane Floyd was an incredibly powerful hurricane that struck the Atlantic region in September 1999. It was the fourth hurricane to hit the area that season, following shortly after other powerful storms. The brunt of the damage from Floyd was felt in The Bahamas and the East Coast of the United States. Atlantic Canada was also impacted.

One of the legacies of Floyd is how it resulted in the fourth largest evacuation in the United States, behind Irma, Gustav and Rita. Around 2.6 million people in five states were ordered by state governments to leave their homes in search of safety.

Floyd reached its highest winds of 155 miles per hour and struck The Bahamas at close to peak strength. It continued to cause similar devastation as it moved up the Atlantic and hit the Cape Fear region of North Carolina as a Category 2 hurricane.

The hurricane claimed a total of 74 lives in the United States and The Bahamas, with the worst impact felt in North Carolina (51 deaths). The state also suffered significant property damage, with many coastal homes destroyed completely. Around four rivers in the state also reached flood levels that had not been seen for 500 years, causing further problems for the State.

Hurricane Bonnie – August 1998

Hurricane Bonnie was a significant hurricane that made the biggest impact in the North Carolina region of the United States. It was the first major hurricane to hit during the 1998 hurricane season in the Atlantic region. During August 1998, Bonnie caused devastation in the Leeward Islands, North Carolina and some mid-Atlantic states.

While the storm peaked as a Category 3, it was downgraded to a Category 2 by the time it hit the coast of North Carolina. It did lose its hurricane status for some time, but it quickly regained wind speeds after meeting favorable conditions. It was back to Category 1-force winds when it made further contact in North Carolina.

The peak wind speeds when it made landfall ranged at around 100 miles per hour, while the rainfall was up to 11 inches at its peak. It is why the structural damage caused to homes in North Carolina was so significant, with windows shattered and roofs torn off completely.

Around $1 billion worth of damage was caused to North Carolina and other American states due to the hurricane. Significant crop devastation also took place. One person died in South Carolina, along with another in North Carolina, due to the storm.

Hurricane Fran – September 1996

Hurricane Fran was a Category 3 hurricane that caused significant damage to South Carolina, North Carolina, Virginia and other American states in August and September 1996. The storm first started as a depression in the middle of August, but quickly rose to a Tropical Storm.

Many were expecting a tropical storm that may hit Florida, Virginia or South Carolina. However, Fran managed to become a Category 2 near the Bahamas. A few days later, it peaked with wind speeds of up to 120 miles per hour and managed to gain Category 3 status. The storm made landfall in Cape Fear, North Carolina in September.

When the storm made landfall in North Carolina, it did lose a lot of its intensity. But the wind speeds and rainfall still managed to cause a lot of devastation up and down the United States’ Atlantic coast.

The casualties as a result of the storm totaled at 27 people, with 14 of the deaths occurring in North Carolina. The state also suffered the most in terms of property damage, with $2.4 billion worth of damage occurring. Virginia and Maryland were also hit significantly, with $350 million and $100 million in property damage in those states.

Hurricane Bertha – July 1996

Hurricane Bertha was a significant Category 3 hurricane that caused devastation in the Leeward Islands, Puerto Rico, North Carolina, mid-Atlantic and New England regions of the United States. It occurred during July 1996, being one of the first major storms of that hurricane season.

When Bertha made contact in and around the Leeward Islands, it was a Category 1 hurricane. But after passing through the islands, it went through a spell of significant intensification, where it reached up to a Category 3. The wind speeds were as high as 115 miles per hour during the peak of this hurricane.

Many homes and boats were destroyed in the United States Virgin Islands due to the hurricane. Bertha caused close to $7.5 million worth of damage in the area. Puerto Rico suffered in a similar way, with one person perishing due to the storm.

The state of North Carolina suffered the most when Bertha finally made landfall there. Many boats, marinas and fishing piers were devastated due to its impact. Many buildings and homes along the U.S. east coast were damaged as well.

In total, 12 people died due to Bertha in the United States, Leeward Islands and Puerto Rico, while a total of $335 million worth of damage occurred in those regions.

Hurricane Emily – August 1993

Hurricane Emily was a 1993 Category 3 hurricane that caused major devastation in North Carolina and other parts of the eastern United States. While Emily started as a tropical wave in the Lesser Antilles, it met wind conditions that resulted in its development into a Category 3 before making landfall.

At its highest level, Emily had sustained winds of 115 miles per hour. Three people died in North Carolina as a result of the hurricane, while around $35 million worth of property damage was done. Most of that damage occurred in North Carolina, but nearby states were also impacted.

Emily took place during the already busy Labor Day weekend in the United States in 1993. Many people had to evacuate their homes when the threat of the storm first became a reality. And around 160,000 people were displaced during that September weekend.

Around 553 homes were damaged as a result of the storm, with about 168 completely destroyed. The governor of North Carolina had issued a state of disaster for the entire state after Emily hit. The President also made the same declaration, allowing people in NC to apply for federal disaster relief funds.

Benefits of Appraisal to Florida Insurance Companies

Speed – The average residential insurance claims appraisal is taking 60, sometimes 90 days or 120 days, to close from start to finish. The differences on these claims are typically from 100 to 300k and are wholly associated with cost and scope. The commercial claims schedule for a standalone business can often be the same but know that a condo can sometimes take a little longer as the understanding of the damage is harder to collect and the costs more complex. Many commercial large loss claims are often resolved in 180 days but can take longer, up to 9 or 12 months, for a final award.

Usually in this amount of time you can arrange an inspection with the appraiser for the opposing side, get to the site, disagree, and set an umpire appointment. In Florida today in most occasions it should be a true appraiser meeting you as compared to the public adjuster appraising his or her own claims thanks to recent rulings as to the requirements to be “independent.”

This meeting is for the panel and I see many appraisers inviting the homeowner, contractor, adjusters, lawyers and a marching band to the panel meeting. I believe to keep efficient the panel meeting should be limited to the appraisers, if possible. It is critical to get the data from the process that preceded us, but equally important to not carry over unnecessary emotion.

Accuracy – The insurance claims appraisal process provides every opportunity to gather the real details of the loss and sweep away mistakes of other early actors. By the time a claim makes appraisal it has usually been measured and beaten about sufficiently enough to at least be the right measurements. The scope should be well defined and developed by the process.

The accuracy of an appraisal can extend beyond the Coverage A and most appraisal we conduct include all coverages. We will almost always include an itemized detail for the award articulating all of the coverages appraised and the values both before and after deductible. Our office includes an Xactimate without values to aid the insured, the mortgage company, FEMA, and the insurer to document the loss and what is paid for.

Productivity – Move the files and that includes into alternative dispute resolution. Nothing better happens the longer a claim stays open. In fact – just the opposite happens. Appraisal allows contractors to go back to building instead of arguing with adjusters. It allows adjusters the opportunity to go serve insureds where they can make a difference and gives appraisers something to do. The process is beautiful in that it has a beginning marked by the demand and an end illustrated in the award.

Insurance is an avalanche of math – numbers and percentages and fractions and some percentage of claims are best served by the appraisal process. Appraisers are set to go out in the field and visit the site again to see what may have been missed or is overblown without a court order and months of arguing process. Appraisers appraise, not litigate or adjust, or all of the others.

Costs – Fee sharing or one-way attorney fees in Florida add significantly to the costs of the file. It is certain there are many losses that require a judge, good counsel, and a jury – but many property claims are not that. The lines between damages caused by a covered loss, old damage, construction defect, and other causes of loss are difficult to understand and even harder to articulate in a written report. However, these differences in damage model may be clear as a day in an appraisal panel inspection.

Months or years of back and forth eliminated by the appraisers meeting and gathering agreement. The less strict methods of process included in appraisal reduces the challenges in every aspect of the loss, from getting agreement for a site inspection to gathering opinions from applicable parties without deposition.

Full Disclosure – Complete is licensed general contracting and engineering company providing specialized forensic services and trial testimony on a number of affairs including land use, construction defect and Wind v. Flood but we would almost always rather be in appraisal. We are members of both the Windstorm Insurance Network Certified Appraiser/ Umpire roster as well as the IAUA Puerto Rico and we appreciate the education both programs bring to the industry. Every appraiser is different, but a quick phone call is perfectly in order to vet an appraiser until you find one that can get your files closed and the insureds down the road.

Read more about Mediation and Neutral Evaluation in the Florida Department of Financial Services website.Hurricane Michael Devastation, Insurance Village & FEMA

Insurance Village Location

The state of Florida’s Chief Financial Officer Jimmy Patronis, said that starting Tuesday October 16th, that Insurance Village will set up in the parking lot of Sam’s Club on 23rd Street at 1707 W 23rd St, Panama City, FL 32405. It will be open from 8am – 5pm. The village and it’s resources are not simply limited to Bay County but everyone with questions and concerns regarding Hurricane Michael is welcome to come through.Patronis continued, “Come to the village. Let’s get your questions answered and tell you what your rights are.”

Lineman and other city, state and federal crews are working around the clock to get some semblance of normalcy back in balance but as they do insurance agencies can step in to fix the community’s other needs.“We see the trucks rolling all over the streets of Bay County,” said Patronis.

The Insurance Village with be equipped with WiFi internet access, cell phones and charging stations and roaming offices to help. The temporary village location is to help get a financial plan in order quickly for all those affected.

Hurricane Michael FEMA Response & Info

Recent updates show that FEMA is located and operating in eleven counties aiding those families affected by Hurricane Michael.

Remember FEMA will never ask for any type of fee regarding their services and will always display valid credentials if they are in fact a FEMA representative. Currently there are twelve teams operating all over the Gulf Coast.Even if you think your renter’s insurance covers everything that was damaged in regard to your property make sure that you file and update all of your info with FEMA to get insight on what they think that you should do to cover your bases.

“The response teams are going into the affected neighborhoods and, as much as possible, going door to door and letting them know people need to register with FEMA,” Nate Custer said.

Staff also will be opening Disaster Recovery Centers in the coming weeks. Those locations will offer one-on-one assistance for anyone who has questions about the FEMA process.

“It’s not assistance that’s going to make you whole again but it’s to try and get people back into their homes,” Custer said.

Hurricane Michael Damage

Understandably, a storm of this magnitude would wreak widespread havoc across the entire panhandle of Florida but since entire areas were cut off from communication Complete Inc has no way of knowing the true devastation. We have drone footage within this article below as an indicator of just what some are dealing with.

Authorities deployed boats and helicopters and we employed drones in accessible areas to try to get a scope of the damage. Due to the makeup of the area this will not not be easy. “This is a very dense part of the state, so it’s going to be a lot of work to get to everybody,” Gov. Rick Scott of Florida said. “But we will get to everybody.”

“It was absolutely horrible, I watched Hurricane Michael lift the houses all around Mexico Beach, Fla., then spin them around and drop them”, said Mexico Beach resident Ted Carranza.

“It was insane,” Mr. Carranza said last Thursday from the town where the storm had crossed onto the state only a day before.

Just a week earlier stood a living, breathing city. Only a week later the quiet town brought to a whisper as piles of lumber, home furnishing, destroyed roofing and memories littered the beachside community.

In these situations, residents usually turn to the military and National Guard for help and advice on how to deal with the storm. But in this instance, it was the military itself that had to worry about its own self-preservation. Panama City’s own Tyndall Air Force Base suffered “severe damage” to “the base infrastructure” as a result of getting pummeled by Hurricane Michael, base officials said.

The entire Air Force base was left without power, water and sewer service. One of the only ways to communicate with base residents as well as those that live surrounding the base has been via Facebook. The base posted on their Facebook profile that recovery teams had uncovered “widespread catastrophic damage” at the facility after just an initial assessment. And while inspecting some of the base’s housing locations, teams “found widespread roof damage to nearly every home.” After a more thorough examination there will no doubt be more damage to deal with.

In a new analysis based on the National Hurricane Center’s (NHC) advisory and CoreLogic, Michael is estimated to have produced between $3 billion and $5 billion in wind and storm surge losses.

Citations:

- http://www.artemis.bm/blog/2018/10/10/hurricane-michael-wind-surge-insured-loss-up-to-4-5bn-corelogic/

- https://www.cbsnews.com/news/hurricane-michael-aftermath-death-toll-rises-as-florida-takes-stock-of-destruction

- http://www.newsherald.com/news/20181015/president-trump-visits-hurricane-michael-victims-with-fema-governor

- https://www.insurancejournal.com/news/southeast/2018/10/16/504583.htm

Puerto Rico Four Months After Hurricane Maria

Four months after the Hurricane Maria struck Puerto Rico, the Federal Emergency Management Agency or FEMA has halted any new shipments of water and food to Puerto Rico. Puerto Rico’s government has been shocked with the decision, stating that it was still talking with FEMA on how it will gain control of water and food distribution. FEMA has stated that this is the longest ever carried out distribution of water, fuel and good in the island’s emergency operation. It has comprised more than 360 million dollars worth of water, and more than a billion dollars worth of food. However, any new food and water shipments will be stopped officially, despite the fact that FEMA currently possesses more than 45 million liters of water, 2 million snack packs and 2 million meals ready for distribution on the ground if needed. The agency has said in a statement that the supply chain of water and food has regained momentum commercially and private supplies are apparently sufficient – hence eliminating the need for commodities provided by FEMA. It has been acknowledged by officials in Puerto Rico too that the conditions have improved over time and the economy is indicating that it will show recovery soon. However, many believe that it is the Trump’s administration that has intentionally disadvantaged Puerto Rico in numerous ways that will not be recovered through any disaster recovery. This is a matter of life and death for more than 3000 Puerto Ricans who are living on mainland hotels in the US.

Puerto’s Rico’s government has expressed that it was completely unaware of this development. It has maintained that it is awaiting information provided by FEMA so it can decide when the supply duties would be shifted from FEMA to Puerto Rico’s Government. They have said that they were not informed by anyone that the supplies would be halted.

FEMA’s spokesperson William Booher has stated that FEMA intend fully to support any need that arises and will continue supplying everything that is required to private NGO’s as well as volunteer agencies. He expressed that they were working in rural and outlying areas and will target all needs relating to this disaster as the water and power is fully restored.

FEMA has personnel of 5000 working on the island and is ready to restore the water and food shipments to the island if the need arises.

Carmen Yulin Cruz, the Mayor of San Juan has expressed shock over the decision on Twitter and urged a reconsideration of this indifferent decision. At a Washington event, Cruz reiterated that numerous schools outside San Juan have no access to power, water or milk. Moreover, electricity has run short and around five hundred thousand power utility customers have had no electricity since the past week.

FEMA has said that nine of the regional staging areas that were established for the distribution of the water and food to the island, as well as 70 mayors, will continue to function as usual. The residents of San Juan have also expressed concern over the ongoing situation. A clinical psychologist who resides in San Juan stated that many outlier towns are still short of water rand food supplies. However some municipalities have regained some normality and do not require food distribution efforts anymore, he said. Transportation has become another major issue as, while some municipalities do have access to roads, most do not. The mountainous areas are still short of portable water as well as power, whereas other areas have lost the main road –hence requiring the locals to drive hours to reach a place that can be covered in 5-10 minutes. Moreover, 35% of Puerto Rico residents do not have access to electricity, more than half a million houses require to be redone either partially or entirely, and many children are unable to go to school due to the current situation. In a situation as crucial and dire as this, Puerto Ricans are appalled that FEMA will halt their water and food supplies all of a sudden. However, FEMA has eventually agreed to back down on halting water and food supplies for the time being. Puerto Ricans believe that they have a right to be helped as they have fought alongside the US bravely in every war or conflict since the 1970s. They believe that this treatment by the US government is prejudiced, discriminatory and racist.

Efforts by New York to help regain power in Puerto Rico have been of help. New York power workers were on the ground right after the hurricane struck Puerto Rico in order to analyse the damage. 90% of San Juan area customers were able to restore power with the help of more than 400 New York State utility workers. However, the situation calls for a much more thorough response and help. Puerto still has broken bridges and tress that have fallen on major highways. Traffic lights have been ruined and storefronts have been shattered. It has been suggested that the disaster aid package be approved and upgraded right away.

There is still a chance for Puerto Rico to recover from this tragedy and regain normalcy. Puerto Ricans have viewed this disaster as an opportunity to develop better roads and bridges that can cover even the rivers. Tourism is being expected to rise when New Yorkers hop on to flights and cruise ships to visit Puerto Rico again, hence helping the economy sustain as Puerto Rico recovers and heals. But all this requires that the island receive more help in the form of FEMA and overall recognition by the US government that Puerto Ricans are also citizens of the United States.

Citations:

https://www.msn.com/en-us/news/us/puerto-rico-fema-to-end-food-and-water-shipments-wednesday-official-says/ar-BBIu5Zb?ocid=spartanntp

https://www.citylab.com/environment/2018/01/san-juans-mayor-to-trump-things-are-not-ok/551840/?utm_source=citylab-daily&silverid=Mzc3MjMwMTUzOTgzS0How does my Hurricane Harvey donation help the real people in Houston, Beaumont and Corpus Christi?

The American Red Cross, a name synonymous with disaster aid and help for those dealing with natural disasters and catastrophes is, post-Katrina now marred with another feeling by the public. It’s lack of trustworthiness and transparency. When we should all be patting ourselves on the back for financially helping all of neighbors along the Southern states we have to now consider whether or not the dollars will make it to their recipients in need.

Unfortunately, in the last decade or so the organization, which is a congressionally chartered instrumentality of the U.S. government, has a history of failing to accurately account for its spending or respond to requests for information. But we all feel that with a little more trustworthiness and transparency they can easily regain the trust of the people.

So how much of the aid given specifically for the Harvey disaster in Houston and other parts of Texas and Louisiana actually gets to those people in those areas? Well according to The Red Cross’ vice president of disaster operations, Brad Kieserman, He could not exactly tell National Public Radio last week what portion of its donations go to Hurricane Harvey disaster relief. And unfortunately the CEO of the Red Cross Gail McGovern didn’t help to calm anyone’s nerves about the “controversy”. She has repeatedly refused to give interviews to NPR in recent years. NPR has stated that is attempting to allow The Red Cross to essentially clear up its name and explain how the funds are allocated when they are promised to certain regions, people or disasters. No comment from McGovern.

The Red Cross wasn’t completely silent however. They know that any response even if it’s not exactly what the public wants to hear is better than no response at all. And in their defense they have many moving pieces in the organization and are trying to do the impossible in what are literally disaster areas. In a statement provided to the Register, the American Red Cross said it segregates donations for Harvey so it goes to the communities affected. “We work to keep our management, general and fundraising expenses low so that on average 91 cents of every dollar the Red Cross spends goes to our programs and services,” it said.The lack of transparency has gotten so bad in recent years and the American Red Cross takes in so much money that Senator Chuck Grassley from Louisiana has co-sponsored the “American Red Cross Transparency Act” to essentially force the charitable organization to open the books. He called on the Red Cross to, “spend donations given for Hurricane Harvey relief wisely and transparently”. And so far The Red Cross does not show any signs of being opposed to this measure as they are trying to update their procedures to be as transparent as they can while helping millions of affected people across the globe.

At the state level the transparency of spending on Harvey relief isn’t unfortunately much better. And not only could the lack of transparency in Texas hinder synergies between groups, encourage fraud and squander an opportunity not only to rebuild after one of the country’s costliest natural disasters, but also to mitigate the risks of the next monster storm.

The state of Texas alone has received more that $11 billion dollars. And unlike money that goes directly through federal agencies that maintain public and frequently updated books and databases of their spending the state of Texas does not keep such records. This seems like a recipe for disaster instead of helping with the Harvey disaster.

So how does the state of Texas spend money differently versus spending and record keeping at the federal level? Well, first it’s much harder to track federal money being distributed through the state and so far $500 million in funds have washed through the state. Most of it has gone to reimburse state agencies and local jurisdictions for debris removal, power restoration and emergency infrastructure repairs. But how the money has been spent is unclear. And for we the people. Or rather we the taxpayers, this is a significant problem.

Governor Abbot can created a commission to help the hardest hit counties to get reimbursed by FEMA but if the commission isn’t tracking the funds, and they’re not, then what is the commission go for? Apparently FEMA puts the responsibility for tracking the funds being spent on local authorities in case of a federal audit. The commission spokesperson Laylan Copelin didn’t inject a vote of confidence much further when she said, “We’re on the service end of things, we’re not really in the money trail.”The U.S. government doesn’t require states to provide a detailed accounting for disaster relief. But that could change under legislation awaiting a vote in the House. The bill, the Disaster Recovery and Reform Act, aims to streamline data on the acquisition and administration of federal funds. And before hurricane season next year Congress should lobby to get some accountability in place or people will be much less likely to give donations and taxes if no one has any idea where the money went.

Citations:

- http://www.ny1.com/nyc/bronx/news/2017/12/18/lack-of-transparency-clouds-texas-spending-after-harvey

See more from Team Complete

FEMA's 50% Rule & How It May Affect Your Property

CGC Restoration Project – Soundside Dr Wind & Flood from Hurricane Ivan 12.4 flood water above NGVD 130 MPH gusts

The Federal Emergency Management Agency [FEMA] has established specific damage assessment guidelines enforced by the Building Code Official pertaining to all structures located in SFHA (special flood hazard area) A & V zones. These guidelines are intended to relieve the country of repetitive loss flood claims, referred to as the 50% Rule. The Substantial Damage/Improvement Rule, states that a building must be elevated and brought into compliance if damaged by any cause(s) for which the repair costs are 50% or more of the value of the building, and the building is both in a SFHA and at a non compliant elevation or in some other way non compliant with current building code for new construction. [FEMA Region VII 04/21/97]The damage can be the result of wind, flood, fire, earthquake or man; the 50% Rule regulation applies to all structures in a designated (SFHA) special flood hazard area [100-Year Floodplain]. When evaluating a structure’s damage, the Building Value, or market value of the structure only, is factored in; the underlying land and exterior improvements are excluded. In many municipalities or counties one may use the tax appraiser’s value plus 20% or have a forensic appraisal done. There are alternative methods of determining Appraised Value including a depreciated line item value which takes into the actual longevity of a select property and is less affected by the “sale” price collected in the Tax assessor’s office.

The FEMA substantial damage rule should not be confused with the “Repairs to Existing Buildings” code called for separately in the International Building Code. This often happens and can be very confusing especially since the International Building Code www.iccsafe.org has gone from one paragraph in 2004 to an entire book with many different levels of alteration or repair today each requiring a different level of upgrade or none at all.

Another facet of the 50% Rule pertains to the Substantial Improvement of a building. This ruling is a potential costs that buyers needs to be aware of. Simply stated, any Pre-FIRM building that is to be remodeled, renovated or improved – when that project cost is 50% or more of the building value – the building will have to be brought into compliance with the NFIP standards including elevation, which may be a deal breaker. Project costs include structural costs, finished materials, built-in appliances, flooring, interior finishes and O&P on the job but these can be normalized to “pre-storm” pricing following an catastrophe. The cost of permitting is not included.

Periodically, FEMA updates and revises the Flood Insurance Rate Maps [FIRM] across the country. When the elevations are digitized they are then referred to DFIRMs. If the revision of these maps includes an increase in the flood elevation requirements for a particular area, then the Post-FIRM buildings in that area will be affected by the 50% Rule. It is important to note that all additions to a Post-FIRM structure must be elevated to or above the current BFE, regardless if they are “substantial” or not.

Elevation Certificates – The first step in understanding your 50 % rule challenge is an elevation certificate. Elevations certificates have gotten better and better over the years and should allow you to understand the elevation of your buildings first and additional floors, grade your required bfe and the zone. This is another part of the program that has seen major changes over the last decade including the requirement to include pictures of the structure as part of the form.

CGC Appraisal – Chateau De La Mer – Coastal Mississippi Flood 86,000 s.f. surge thru first elevated floor wind removed roof

Many communities, based on location and topography, also implement additional “free-board” requirements. For instance, many coastal communities including mine Santa Rosa County enforce a 3-foot free-board requirement, which means that an additional 3′ of elevation is required above whatever flood identified as a base flood.Another local ruling to consider is Cumulative Costs. The general ruling is that all separate permits for the same structure within a one or two year period are considered to be a single improvement; the time period varies from area to area. Properties with repetitive losses over a five year period are commonly affected by this portion of the programs requirements.

Being informed and aware of all national and local regulations is the best way to protect your property and to fall into compliance. Please understand this is an extremely important site specific issue that requires a professional surveyor, potentially advice from your local flood plain manager, your insurance agent and a real understanding of the costs of restoration to a damaged structure. Mistakes made immediately after a loss can become very expensive as elevating a slab on grade house is many times not cost effective especially with a cap of $30,000 for code on the Flood Insurance Program.

Complete specializes in hurricane damage expert consulting. John Minor, CGC, CFM has worked post-hurricane sites since Opal in 1995; his experience is far reaching – from the Carolina’s to Texas and all along the coast of Florida. The engineers, flood plain managers and contractors of Complete can meet with you to review your preparedness plan, and we will be there afterwards should you ever need us. We specialize in the understanding of the costs repairs necessary to restore buildings damaged by wind, fire, flood manufacturer ofr builder defect.

Call the company the pros choose – call Complete.

Oil and Water Do Not Mix – National Flood Insurance Program

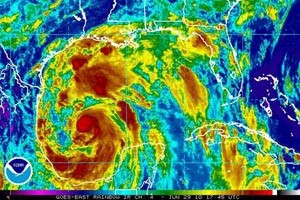

Hurricane Alex Satellite: Image provided by NOAA The National Flood Insurance Program (NFIP) receives an extension of approval as Hurricane Alex made landfall just south of the Texas border…

Last week, the U.S. Senate approved a temporary reauthorization of the National Flood Insurance Program until Sept. 30. The reauthorization of the National Flood Insurance Program (NFIP) is retroactive to June 1, the date the program was halted. The unanimous Senate vote sent the measure to President Barack Obama for his signature. The House had previously approved reauthorization.

Once President Obama signs the bill into law, the NFIP should return to normal operations, according to the Independent Insurance Agents & Brokers of America (the Big “I”). Also, since the extension is retroactive, any new policy applications or renewals that were signed and submitted during the hiatus will be effective from the date of application or, in the case of waiting periods, the waiting period will start from the date of application. The Big “I” said that while the resumption of the program is welcome, the spring lapse — the third time this year it has been forced to halt operations– has caused difficulties for homeowners and small businesses. For more information…

In the Event of a Declared Flood… FEMA Sets Guidelines

U.S. Coast Guard Deployment: Photo by John Minor The Federal Emergency Management Agency has clarified that in the event of a declared flooding disaster, National Flood Insurance Program coverage will apply even if oil from the British Petroleum deep well blowout in the Gulf of Mexico is mixed with flood waters.

The NFIP will bill BP for reimbursement for any claims it pays for covered properties affected by flood waters mixed with oil from the BP spill. In a memorandum issued to insurance industry Write Your Own flood program particpants, James A Sadler, director of Claims for the NFIP, said that oil in flood water is not a new development for the flood insurance program. However, in order for coverage to apply there must first be a definitional flood as described in the Standard Flood Insurance Policy (SFIP). Damage caused by the oil in flood waters is covered subject to the provisions of the SFIP; other stipulations provided in the memo include:

An oil smeared Pensacola Beach: Photo by John Minor - Coverage for commercial buildings and contents must be purchased separately and the limit for damage caused by pollutants is $10,000.

- Homes and contents are covered up to the policy limits.

- NFIP only pays for direct physical loss by or from flood.>

- Condominium contents are covered to the policy limits.>

- Damage to ground, soil, or land caused by flood, oil, or flood water mixed with oil is not covered.

- The cost of complying with any local or state ordinance including one that requires special removal methods for oil is specifically excluded (certain floodplain management mitigation requirements are exceptions).

- There is no coverage for testing for or monitoring of pollutants unless there is a law or ordinance requiring it.

- If the policyholder makes any claim against any person who caused the loss and recovers any money, the policyholder must pay FEMA or the WYO back first before the policyholder may keep any of that money.

Pensacola Beach Cleanup: Photo by John Minor “It seems that what was referred to as ‘flood’ is covered except for where it is not [pollution]. My take is that this statement identified that the claims will be paid as they always have which does not include the use of hazmat certified demo crews. Additionally, it shares that land is not covered. Land and/or shore restoration is going to likely be a bigger issue especially in a smaller storm that only causes limited ‘flooding’. I can’t even imagine the result if there was a big storm pushing significant amounts of oil into occupied FEMA elevation-compliant occupied spaces. I know that NFIP will do the best that they can but there comes a point in every policy where hard decisions must be made. I think this question begs further analysis by folks higher on the pay grade than a general contractor from Pensacola.” – John Minor

John Minor is a licensed general contractor, insurance appraiser and umpire with HAZMAT certification under Title CFR 1910.120 (OSHA HAZWOPPER).Complete General Contractors, Inc. specializes in hurricane damage restoration from residential, commercial, industrial and by municipality. John Minor has worked post-hurricane sites since Opal in 1995; his experience is far reaching – from the Carolina’s to Texas and all along the coast of Florida. The staff of Complete can meet with you to review your preparedness plan, and we will be there afterwards should you ever need us. We specialize in the actual restoration, prevention, as well as, dispute resolution of a claim.Call the company the pros choose – call Complete.

This information should not be substituted for professional legal advice; consult with your lawyer for legal advice and ask your insurance professional to discuss the details of your policy and insurance needs.